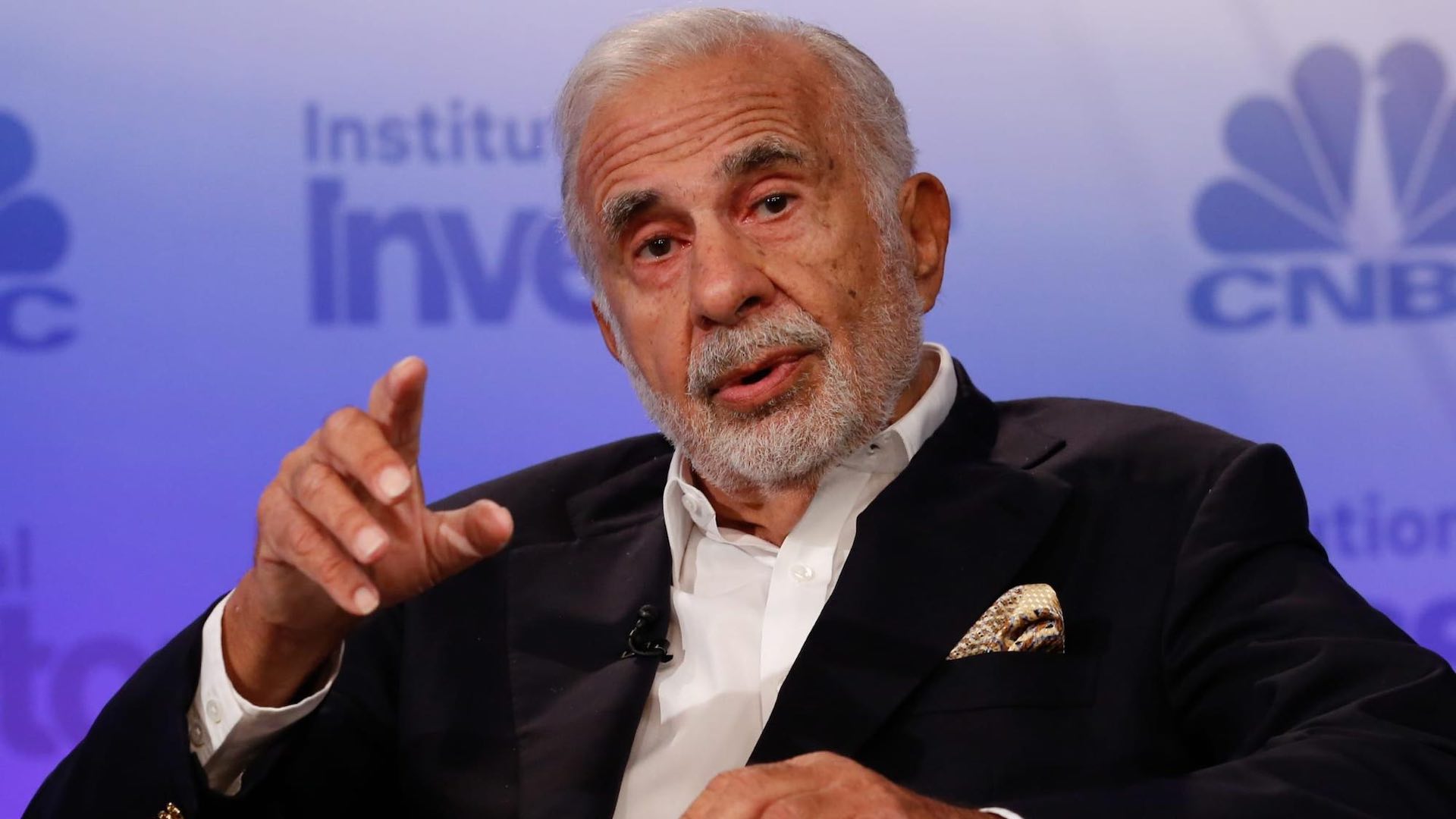

Carl Icahn, the activist investor known for instigating corporate confrontations, has recently become a target himself. Hindenburg Research, a notorious short-selling research firm, disclosed a short call against Icahn’s investment outfit, stirring up considerable criticism for the veteran investor. The announcement resulted in a steep fall in Icahn Enterprises LP’s shares, marking the largest single-day drop in the company’s history.

Hindenburg Research published a comprehensive report alleging overpricing of Icahn Enterprises and inflated valuations of several of its assets. Carl Icahn swiftly responded to these allegations, defending his firm’s performance and expressing confidence in its long-term resilience. Hindenburg’s report counters this by stating that Icahn, a Wall Street legend, has committed the classic error of excessive leverage amidst ongoing losses, a combination often associated with disastrous outcomes.

This development sets up an intriguing face-off between the 87-year-old Icahn and Hindenburg’s founder Nathan Anderson, who has earned a reputation for his firm by challenging major corporations such as Block Inc. and Gautam Adani’s business conglomerate. Hindenburg’s report suggests that Icahn Enterprises’ value is overstated by at least 75%, trading at a premium more than double its net asset value. This contrasts with other closed-end holding companies like Dan Loeb’s Third Point and Bill Ackman’s Pershing Square, which, according to Hindenburg, trade at discounts to their NAV.

The report also probes into the sustainability of Icahn Enterprises’ dividend yield and its financing over recent years. Hindenburg alleges that Icahn has been using funds from new investors to distribute dividends to existing ones, likening such practices to a Ponzi scheme. Furthermore, it casts doubts on the sole major investment bank, Jefferies Financial Group Inc., providing research coverage on Icahn Enterprises. Hindenburg points out that Jefferies’ research, even in its bear case scenario, presumes the safety of IEP’s dividend ‘into perpetuity,’ without substantiating this assumption.